Why AgTech Is the Smartest Investment in 2025?

Introduction

For years, Agricultural Technology (AgTech) simmered with speculative hype, attracting a flood of capital chasing futuristic promises.

That era is over.

In 2025, the landscape has fundamentally changed.

The post-hype “capital drought” has enforced a crucial market discipline, clearing the field of ventures built on promise alone and leaving behind a cohort of resilient companies with proven unit economics, demonstrable ROI, and scalable solutions.

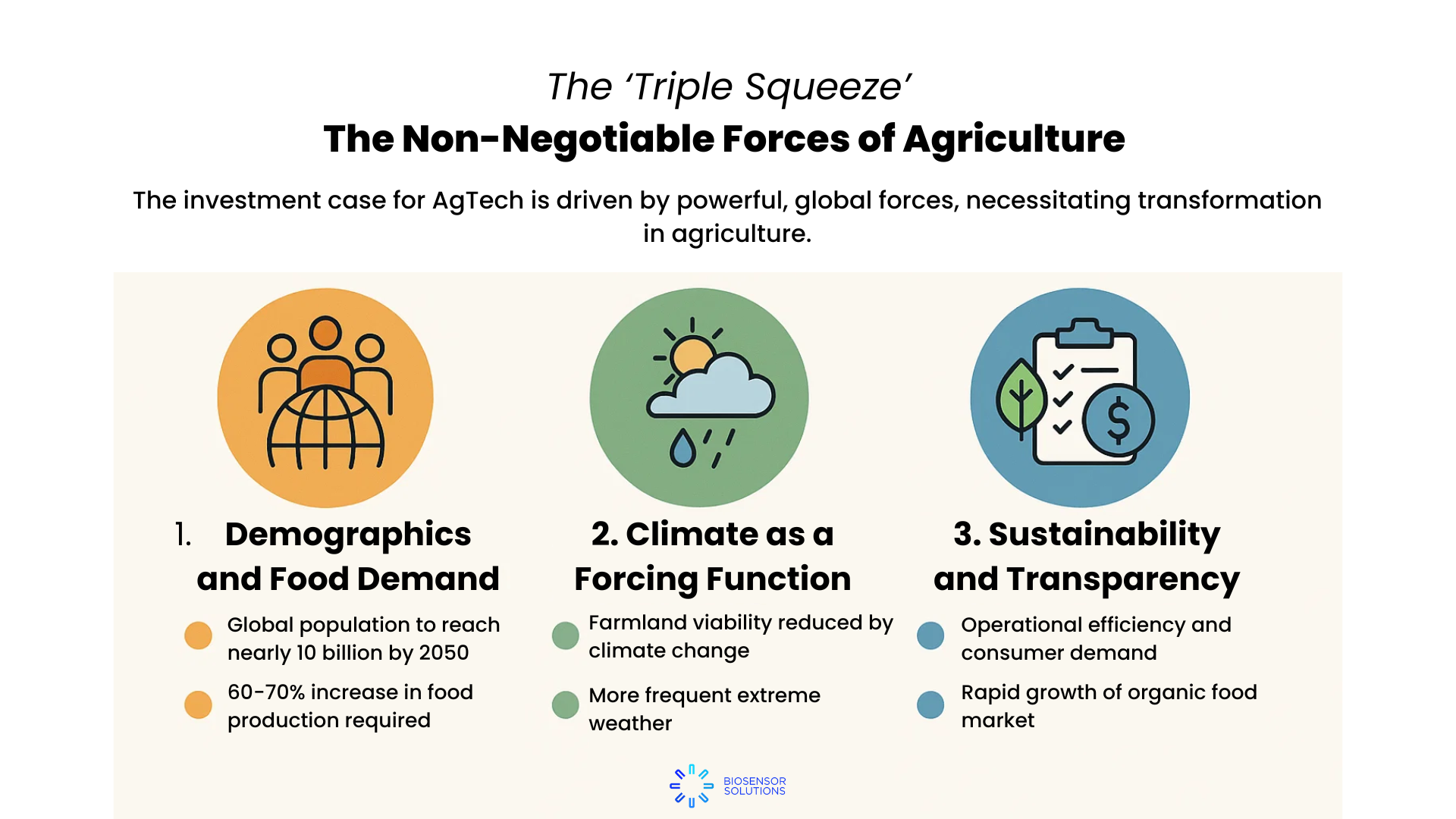

This market recalibration presents a de-risked and timely entry point for discerning investors. But the real story isn't just about market timing; it's about necessity. The global food system is being squeezed by three immense and converging pressures: a relentlessly growing population, the escalating instability of climate change, and an unwavering consumer demand for sustainability.

This "Triple Squeeze" makes incremental improvements to our current agricultural paradigm insufficient. It creates an inelastic and permanent demand for the efficiency, resilience, and systemic transformation that only technology can deliver.

For investors with a long-term horizon, AgTech in 2025 is no longer just a viable sector; it is the most intelligent and essential allocation of capital for addressing the defining challenges of the 21st century.

The ‘Triple Squeeze’: The Non-Negotiable Forces Forcing Agriculture's Hand

The investment case for AgTech is not built on speculative tech trends but on the stark reality of powerful, non-negotiable global forces that make transformation an imperative, not an option.

1. The 10-Billion Person Question: Demographics and Food Demand

The most fundamental driver is the simple arithmetic of human population growth. The global population, standing at 8.09 billion at the start of 2025, is projected to reach between 9.7 and 9.8 billion people by 2050.

To meet the caloric needs of this larger, more urbanized population, the Food and Agriculture Organization (FAO) estimates that overall food production must increase by a staggering 60-70% compared to mid-2000s levels. This requires producing nearly one billion more tonnes of cereal and over 200 million more tonnes of meat annually.

Compounding this raw increase is a significant dietary shift.

As incomes rise in developing nations, consumer preferences move away from staple grains towards more resource-intensive, animal-sourced proteins, placing immense additional pressure on land, water, and feed.

The current agricultural system, characterized by slowing yield growth and a degrading resource base, is mathematically incapable of meeting this demand without a paradigm shift in efficiency. This creates a powerful, long-term tailwind for any technology that can fundamentally increase yield and optimize the entire food value chain.

2. Climate as a Forcing Function: The New Agricultural Reality

Climate change is no longer a future contingency; it is a present-day variable actively degrading agricultural capacity. The Intergovernmental Panel on Climate Change (IPCC) reports with high confidence that climate change is negatively affecting agriculture, forestry, and fisheries. Global agricultural productivity growth has already slowed by an estimated 21% over the past 50 years due to human-induced warming.

The impacts are tangible:

Shifting Farmland Viability: Some current crop and livestock areas are projected to become climatically unsuitable.

Extreme Events: The frequency of sudden food production losses from droughts, floods, and heatwaves has increased, with the risk of extreme agricultural droughts potentially doubling at 2°C of warming.

Direct Food Insecurity: These climate impacts are key drivers in the rise of undernutrition, potentially pushing an additional 8 to 80 million people into hunger by 2050.

This reality acts as a powerful forcing function, invalidating traditional farming models and creating urgent, market-based demand for climate-resilient solutions like drought-tolerant crops, hyper-efficient irrigation, and alternative production models like Controlled Environment Agriculture (CEA).

3. The End of Inefficiency: The Push for Sustainability and Transparency

The third major force is a dual-sided push for sustainability, originating from both operational economics and consumer demands. The 20th-century model of agricultural intensification is no longer tenable; efficiency is now a core driver of profitability.

This is powerfully reinforced by market demand. Consumers are increasingly sophisticated and ethically aware, fueling explosive growth in markets that can verify their sustainable origins. The global organic food market is projected to expand from $286.4 billion in 2025 to over $1 trillion by 2034. This demand for transparency has made traceability a non-negotiable aspect of the modern food supply chain, creating an immediate market for digital technologies like AI, IoT, and blockchain that can provide immutable, end-to-end visibility from farm to fork.

Why 2025 is a Savvy Investor's Market?

After a period of exuberant investment that peaked with a record-breaking $51 billion in agrifoodtech funding in 2021, the sector experienced a sharp but necessary contraction. This market correction has created a healthier and more discerning investment environment for 2025.

The End of "Growth at Any Cost"

The era of funding growth at all costs is over. Global VC funding in the sector fell to $16 billion in 2024, a modest 4% drop from 2023 but a stark illustration of the end of the hype cycle. This "capital drought" has instilled renewed market discipline. Investors are intensely focused on fundamentals: proven economies of scale, a clear financial value proposition, and scalable business models.

For an investor entering the market now, this landscape is highly advantageous. The competitive field has been cleared of the weakest players, valuations are more grounded in reality, and the remaining companies are more resilient.

The Great Bifurcation: Where Smart Money is Flowing

A clear divergence in capital allocation has emerged. Funding is disproportionately flowing towards what can be termed "Hard Tech"—sectors like Agricultural Biotechnology, advanced sensors, and robotics. These areas are characterized by deep R&D and defensible intellectual property (IP). In 2024, Ag Biotech was the best-funded upstream category with $1.9 billion in investment. In contrast, "Soft Tech"—like commoditized farm management software—faces greater challenges unless it possesses a unique, proprietary data asset.

Strategic Acquisitions Over Mega-Mergers

The M&A landscape has also shifted. Rather than large-cap consolidation, the trend is for strategic, targeted acquisitions by mid-tier players and private equity firms executing "roll-up" plays. Two recent transactions exemplify this logic:

Oishii's Acquisition of Tortuga AgTech: Oishii, a vertical farming company, acquired Tortuga AgTech, a robotics firm, to solve a critical operational bottleneck: labor-intensive harvesting. This was a strategic move to directly improve unit economics.

CoStar Group's Acquisition of Ag-Analytics: CoStar, a real estate marketplace, acquired Ag-Analytics for its proprietary agricultural land data platform, AcreValue. They didn't buy a farm; they bought an information asset to gain entry into the $3.4 trillion farm real estate market.

This environment provides a clear exit pathway for startups developing best-in-class solutions for specific problems, making them highly attractive acquisition targets.

Where to Invest: Unpacking the Engines of AgTech Growth

The 2025 landscape is dominated by several key sub-sectors that are technologically mature and address the core challenges of the "Triple Squeeze."

1. Precision Agriculture: The Brains of the Modern Farm

This is the most mature AgTech segment, leveraging data to deliver immediate ROI.

AI & Machine Learning: AI is the core utility, ingesting data from satellites, drones, and sensors to create "prescription maps" that guide machinery to apply water and inputs with surgical precision. This can save up to 27.6% of water and 57% of energy.

The Connected Field (IoT): In-field sensors monitor soil moisture, pH, and nutrient levels, enabling automated and optimized irrigation that can cut water use by 20-60%.

A prime example of a high-potential investment within this IoT space is the emerging field of soil biosensors.

Unlike traditional sensors that measure physical properties, biosensors use biological components to provide real-time data on the soil's living ecosystem. Imagine a farmer being able to instantly detect the presence of a specific root pathogen long before visual symptoms appear, or to measure the activity of beneficial nitrogen-fixing microbes to optimize the application of biofertilizers.

Companies developing these advanced biosensors are creating a new layer of actionable intelligence, representing a highly defensible investment in the future of data-driven agriculture.

Drones: Drones have become indispensable tools for crop scouting and precise application of inputs, reducing water usage by up to 90% and chemical inputs by 40% in certain crops.

2. Robotics & Automation: Solving the Labor Crisis

Directly addressing critical labor shortages, the agricultural robots market is poised for explosive growth, projected to expand from roughly $12-16 billion in 2025 to over $50-100 billion by the early 2030s. Key applications include autonomous planting, robotic harvesting of high-value specialty crops, and AI-powered weeders that can reduce herbicide use by up to 95%.

3. Agricultural Biotechnology: Rewriting the Code of Resilient Food

This sector holds the most profound potential for long-term value. The CRISPR gene-editing revolution allows scientists to make precise, targeted changes to a plant's DNA, creating crops with enhanced climate resilience (drought/heat tolerance), disease resistance, and improved nutrition.

4. The Unseen Foundation: Why Cryopreservation is a Master Key Investment

The entire multi-billion-dollar agricultural biotechnology enterprise is fundamentally dependent on one often-overlooked area: the conservation of Plant Genetic Resources (PGR). These diverse crop varieties are the biological library from which all valuable genetic traits are drawn. Cryopreservation—storing living plant material in liquid nitrogen at -196°C—is the only viable technology for the long-term, secure preservation of this irreplaceable genetic heritage.

By halting all metabolic processes in a state of "suspended animation," cryopreservation secures the raw materials for all future biotech innovation. The maturation of techniques like vitrification, droplet-vitrification, and cryo-plates has made this a large-scale, operational technology. Investing in companies that improve the efficiency, cost-effectiveness, and automation of cryopreservation is a foundational, "picks and shovels" investment in the entire future of food.

5. Diversified Growth Opportunities

Controlled Environment Agriculture (CEA): The recent market shakeout has revealed that the smartest play is not in the farm operators themselves, but in the providers of enabling technologies—energy-efficient LEDs, advanced climate controls, and automation—that are essential for profitability.

Alternative Proteins: This massive market is projected to grow to over $417 billion by 2034. The most strategic investments are in ingredient technology, particularly microbial and precision fermentation, which supply high-value ingredients to a wide range of food manufacturers.

Carbon Farming (MRV Platforms): As the voluntary carbon market shifts towards high-integrity, verified credits, the most critical investment opportunity is in the digital Monitoring, Reporting, and Verification (MRV) platforms that can accurately measure on-farm carbon sequestration.

Eyes Wide Open: Understanding and Mitigating AgTech Risks

A credible thesis must assess risks. The most successful AgTech companies are those adept at navigating these headwinds:

The Adoption Hurdle: High initial costs and complexity are major barriers for risk-averse farmers. The mitigation is a shift to innovative business models like "AgTech-as-a-Service" subscriptions and pay-per-use plans that lower the entry barrier.

The Regulatory Maze: Complex regulations around gene editing, data privacy, and drone operations can be significant hurdles. The ability to skillfully navigate these frameworks can become a powerful competitive advantage.

Market Volatility: The agricultural sector is subject to unpredictable weather, commodity price cycles, and geopolitical events. The most resilient investments are in technologies that either help farmers mitigate this volatility (e.g., resilient crops) or are structurally insulated from it (e.g., CEA).

Investing in Necessity

The investment case for Agricultural Technology in 2025 is not a forecast of future possibility; it is an assessment of present necessity. The market has matured beyond speculative hype, offering a landscape of de-risked opportunities for strategic investors.

The ideal investment target is a company solving a quantifiable pain point with a defensible technology moat and a scalable business model resilient to market volatility.

In 2025, AgTech is no longer just about deploying novel technology. It is about deploying proven, profitable solutions to solve the most fundamental challenges facing humanity: feeding a growing population on a changing planet, sustainably and securely.

For this reason, it represents the most critical, and therefore the smartest, long-term investment of our time.

A New Opportunity in Soil Health

The best way to understand farming is to get better information from the fields. Our new soil biosensors are designed to do just that by listening to the biology of the soil in real-time.

What They Do: Instead of just measuring moisture, these sensors can detect specific microbes or pathogens in the soil. This allows you to spot diseases before they damage your crops and apply biological fertilizers only when they will be most effective, saving you money and improving soil health.

This technology is a major leap forward in farming and represents the kind of smart investment opportunities we've discussed. We are currently looking for investors to help fund this foundational technology. At the same time, we're inviting forward-thinking growers and research labs to join our paid pilot programs to be the first to use these powerful insights on their land.

Please contact us to learn more about investing or joining a trial.

Join Our 2025 Regenerative Digital Soil Health Pilot!

Are you a grower, farm advisor, or ag-tech provider exploring the future of regenerative agriculture?

BioSensor Solutions is launching our 2025 Digital Soil Health Pilot — and we’re seeking forward-thinking partners to join us.

Ideal Pilot Partners

- 🌿 Growers and farm advisors — trialling regenerative practices

- 🧪 Biofertilizer producers — validating microbial performance

- 🔗 Ag-tech integrators — embedding live soil data

- 🛒 Retailers — enabling regenerative sourcing

Let’s Collaborate!

We’re currently partnering with innovators across the agriculture value chain to test and refine our real-time soil sensing platform. If you're ready to explore what’s happening beneath the surface, we’d love to hear from you.

Contact us today to schedule a meeting and learn more about the pilot program.

Anjali Singh is a scientific content creator who combines her background in plant biotechnology, deep interest in soil science, and strong writing skills to craft clear, engaging content—from in-depth articles to impactful social media posts.

She specializes in translating complex scientific concepts into accessible, meaningful narratives that inform, inspire, and spark curiosity.

As a committed science communicator, Anjali’s goal is to make science approachable while fostering a deeper understanding and appreciation for the natural world.

🔗 Connect on LinkedIn